Table of Content

But with rates inching back up, taking cash out when you refinance means your monthly payments will be higher—on top of the $2,000 to $3,000 it costs to refinance. Still, if you own your co-op apartment outright, Bank of America says you can borrow up to 80% of its value, with 90% of that having a fixed interest rate and the other 10% having a variable one. You may then take your entire credit amount at closing and start repaying it with no prepayment penalty, which is just like getting a lump sum from a home equity loan. However, Bank of America notes that the loan is not an easy one to get. It requires "a lot of paperwork," as part of the underwriting process involves looking into how successfully the particular co-op operates.

A loan modification is an agreement between you and your mortgage company to change some aspect of your original loan. Usually, the loan modification aims to reduce your monthly payments. For example, you might agree to change how much you pay, how long you’ll pay the mortgage, or reduce the interest rate.

Loans

At the same time, a home equity line of credit is a specific limit you can use and pay back whenever you need money. It only works like a credit card because your home acts as collateral here. If it is below 30%, you have a good chance of getting your loan application approved. In addition, you do not need a lot of documents to get a loan here – all you need is to provide your Social Security number, proof of income and employment, and tax returns. You must pay early termination fees if you repay the loan early.

Search various loan provider to see which one can offer you the most effective bargain that can conserve you hundreds or perhaps thousands of dollars. Non-payment of the financing can lead to someone losing his residence. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles.

Conventional vs. FHA and VA loans: Find out which mortgage is right for you

When this happens, you could become underwater on your loans, meaning that you owe more on your home than it is worth. That, in turn, could prevent you from selling the home until its value increases or you've paid down your loans sufficiently, which might take years. When you have a few candidates in mind, be sure to get estimates from each lender so you can do some comparison shopping.

The home equity loan is a great way to lock in your monthly payments,” Baldwin says. Home equity loans are available from many of the same lenders that issue regular mortgages. If you belong to a credit union, it will most likely offer a home equity loan option with highly competitive rates and fees. In addition to credit unions, many banks offer low- or no-fee home equity loans. You will need to provide proof of income, proof of assets and proof of any financial liabilities.

Loan Land Purchase Top 3 List

The bank will need to see copies of financials and other documents. Your credit score can have an impact not only on your ability to get a mortgage, but also on the loan’s rate and terms. Mortgage lenders consider your score, alongside other factors like employment, income and debt, to determine whether you can realistically afford the home you want. If you’d rather not take on a loan that’s secured by your home, consider a personal loan instead. Unsecured personal loans allow you to borrow money without collateral.

The amount of a home equity loan is large enough to cover all such expenses. But, unfortunately, you can’t get a home equity loan fast – it can take anywhere from two weeks to a few months. You also provide documentation and an estimate of the value of your home. This is an excellent option for anyone with a high FICO score. Check out the options below and choose the one that suits you best. The challenge isn't how to make more money, it's how to make and use money to live a life you love, with time and space for yourself.

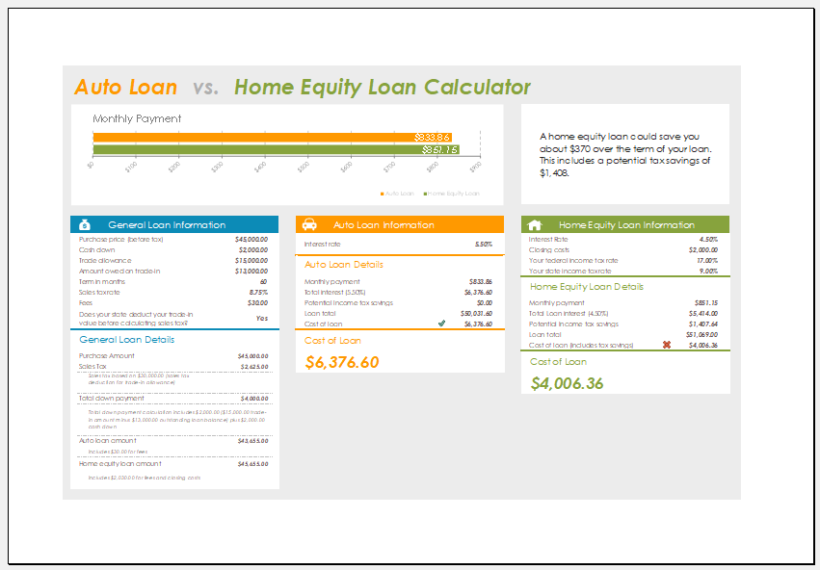

Home Equity Loan ComparisonSecond MortgageHome Equity Line of CreditAdvantagesInterest rates are locked in over the life of the loan for most Second Mortgages. A home equity loan gives you a lump sum of cash, which you pay off with consistent monthly payments in addition to your current mortgage payment. Home equity loans usually have fixed rates and because your home serves as collateral, rates are typically lower than unsecured loans, like credit cards.

She is the co-founder of PowerZone Trading, a company that has provided programming, consulting, and strategy development services to active traders and investors since 2004. Minnesota has the highest average credit score, 742, followed by Vermont and Wisconsin , according to Experian data. 768 is the median credit score in the U.S. for those taking out a mortgage, according to Q Federal Reserve Bank of New York data. Products in only a handful of states including Texas, Alabama, New Mexico, Florida, Colorado and Arizona. For homeowners in these states, Prosper makes it simple to get approved for a loan for up to 95% of your home's value for qualified borrowers. Alix is a staff writer for CNET Money where she focuses on real estate, housing and the mortgage industry.

If you miss your loan payments, your co-signer’s credit can suffer, along with yours. And if you fail to make your payments, the co-signer becomes legally responsible for the debt. Of course, the hope is that you would never end up in this situation. But if you do, it can damage your relationship along with both of your credit scores. Most lenders require a score of at least 680 in order to get approved for a home equity loan. However, you may still be able to qualify for a home equity loan with bad credit.

If you’re a co-op owner, you might wonder if you can get a home equity loan. After all, these loans let you tap into your home equity to pay for renovations, consolidate debt, or finance significant expenses. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team.

You’re most likely going to need good credit if you want to get a home equity loan for your mobile home. Bad or even average credit may not be enough to secure a loan. You then have to determine if you want a home equity loan or a home equity line of credit . One option is to take out a home equity loan against your mobile home.

She previously reported on retirement and investing for Money.com and was a staff writer at Time magazine. She has written for various publications, such as Fortune, InStyle and Travel + Leisure, and she also worked in social media and digital production at NBC Nightly News with Lester Holt and NY1. She graduated from the Craig Newmark Graduate School of Journalism at CUNY and Villanova University. When not checking Twitter, Alix likes to hike, play tennis and watch her neighbors' dogs. Now based out of Los Angeles, Alix doesn't miss the New York City subway one bit. This San Francisco-based peer-to-peer marketplace lender has a streamlined online application process and can get you funds in as little as 11 days.

No comments:

Post a Comment