Table of Content

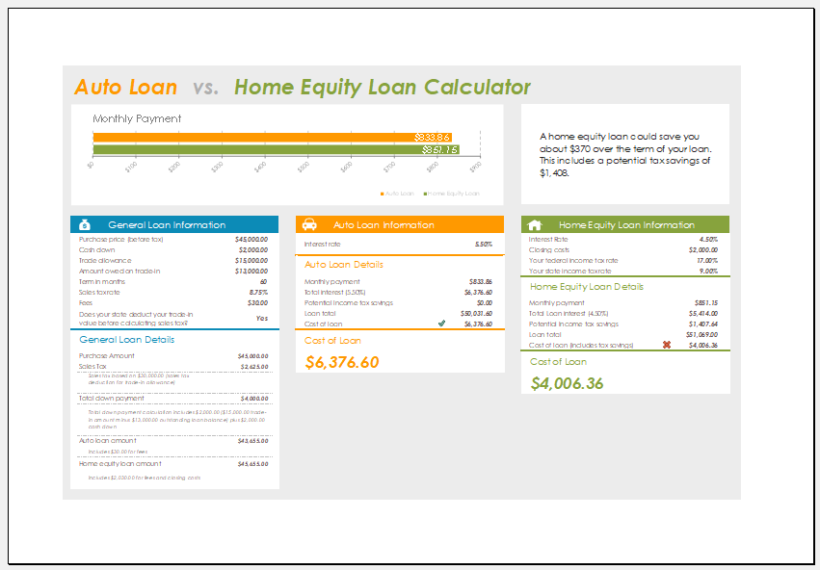

For example, if your place is worth $1 million and you have an existing $500,000 mortgage, you’ll be able to finance an additional $300,000, bringing your total debt to $800,000. Coop Fed offersHome Equity Lines of Credit , a type of mortgage which allow you to draw down funds on a revolving basis for up to fifteen years. Monthly payments are based on the amount you owe at a given time, and adjustable interest rates. If you’re considering a home equity loan—and your co-op permits it—shop around to get the best deal available.

Home equity loans are available in more places than you might think. This article explains where to find home equity loans, how they work, and how to make sure you're getting a good one. The rule of thumb for obtaining lendings is to understand the right reasons for that funding and also recognizing how to satisfy your obligation of paying it back in a timely manner. Reverse mortgage is developed for the elderly populace and allows them to take advantage of the equity of their houses now. Based on the last housing crisis, the impact can range between 30 to 100 points downward, according to a paper from the Boston Fed. You put down $30,000 when you bought it and since then, you have paid $30,000 in mortgage principal.

Mortgage & Loans | Reading Cooperative Bank

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners.

That includes the loans' fees, terms, and annual percentage rates . You should use the APR when comparing costs to get the most accurate comparison. Since there is little overhead compared to a brick-and-mortar bank, online lenders can transfer those savings to their customers in the form of lower interest rates and fees. Plus, it’s easy to get quotes online without a hard credit inquiry, allowing you to get several offers to compare within a few minutes. According to Fannie Mae’s policy, a completed modification isn't considered a significant derogatory credit event.

Thinking about buying but not sure where to begin? Start with our affordability calculator.

The second type of home equity loan offered by Guardians CU is a Home Equity Line of Credit . This is a line of revolving credit with an adjustable interest rate, great for short-term borrowing or unexpected costs such as a medical emergency. Guardians Credit Union will set a preliminary limit to the credit line, possibly giving the borrower access to up to 80% of the value of their home depending on credit history, less any liens. HELOCs have sometimes been compared to credit cards, in that you're given a limit. Just like a credit card, you pay interest on the amount you borrow.

However, it is crucial to understand that there are plenty of offers on the market, and some financial institutions are willing to give you a loan if they see proof of your creditworthiness. The main disadvantage of this option is that the lender does not want to work with borrowers whose FICO score is below 700 points. However, at the same time, it is one of the few lenders that allows you to get a loan for five years or more at such a low APR (7%-12%). You can get a small loan of up to $150,000 secured by the equity in your home here. It will have a maximum repayment period of 20 years, and you won’t even need to leave your home to get the money, as the bank accepts all applications online from any state.

Secure Co-Op's Board Approval

For example, the bank does not state a maximum LTV or minimum debt-to-income ratio that borrowers must have, nor does it name FICO score requirements. The maximum repayment period of a home equity loan from BMO Harris Bank is 20 years. You only need essential documents such as the Social Security number, proof of income and employment, and information about debts and other financial obligations to get the money.

If you’re age 62 or older, you may be able to leverage your home equity in the form of a reverse mortgage. Rather than paying back the loan in monthly installments, you receive either a lump-sum, monthly payments or line of credit. The interest is added to your loan balance and doesn’t need to be paid until you move out or die. In most cases, the home is then sold and proceeds are used to pay off the balance. Your debt-to-income ratio is one of the most important factors that lenders consider when approving you for a mortgage.

Your home also has to also qualify as a mobile home in the eyes of the lender. Most lenders require the home to be set on a permanent foundation, so it can be tricky to find a lender familiar with mobile homes. There might also be restrictions in place for mobile homes built before a certain year.

While a loan modification won’t impact your credit score as much as late payments, a foreclosure, or bankruptcy, a loan modification could change your credit score. Ensure your finances are stable before considering additional debt. A home equity loan lets you tap into your equity—the percentage of your home’s value that you already own—to pay for almost anything you might wish. Intelligent uses could include home improvements, debt consolidation, and big-ticket purchases such as a house, a new business venture, or medical bills. Your lender gives you a lump sum at a fixed interest rate and you repay the amount in monthly payments, the amount of which remains the same over the loan term, usually between five and 30 years.

Before you move forward, speak with a financial adviser about your options. You want to make sure that the monthly payments are manageable, that you fully understand the terms, and that the loan fits in with your long-term financial goals. You could do a cash-out refinance, even if you don’t have a current loan on the apartment, or take out a HELOC. “You could be 120 years old or 20 years old and still take out a 30-year mortgage,” Mr. Tolmie said. The bank just wants to verify your ability to pay back the loan, so it will want to see evidence that you have the income to do so.

Lenders use what’s called a loan-to-value ratio that divides your current mortgage balance against your home’s current appraised value. For example, if your home is worth $300,000 and you still owe $240,000 on your mortgage, your LTV is 80% ($240,000/$300,000). Know your Borrowing Legal right- The federal government has actually required lenders to completely divulge the regards to a financing to a consumer.

No comments:

Post a Comment